THE PROBLEM WITH PIECE PLANNING

“It’s not what you get but when you get it.”

Today many retirees are living 30+ years. They chance markets will rise to the occasion and support their retirement lifestyles. Believing their well-planned conservative approach will surely guarantee financial security in the golden years.

But will it?

Unfortunately, even conservative plans are impacted and exposed to significant market downturns. Market downturns cause an often-overlooked domino effect. It is not just the loss during the downturn period but rather the affect the downturn has on the remaining years of investments. Simply put, losing money in early retirement years will set the pace to the possibility of outliving funds. This often-snubbed pitfall is caused by the “sequence of returns.”

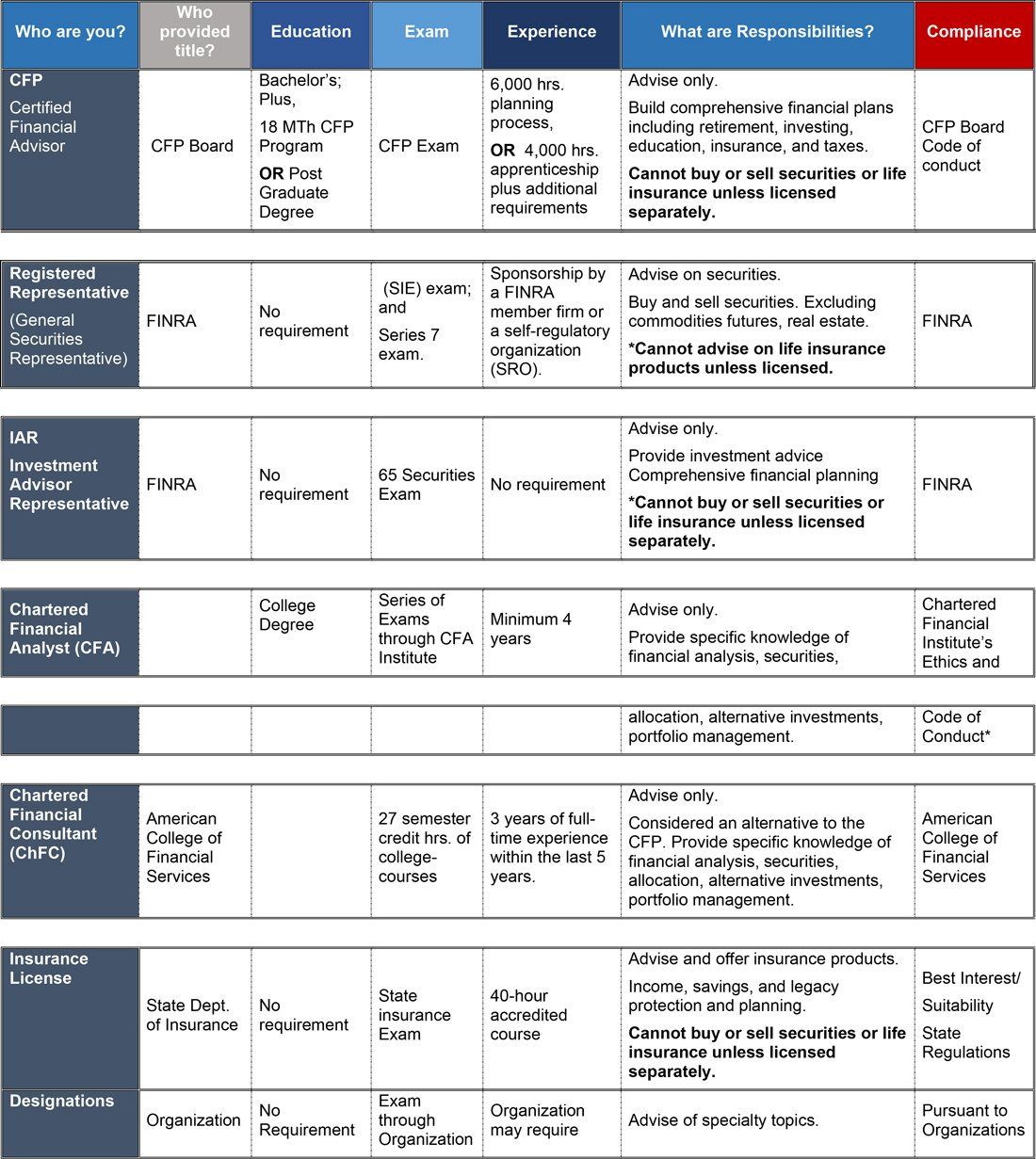

Let’s take a look at how sequence of returns works with a five-year market return run.

Hypothetical Portfolio Value 100K

| Year | A | B |

|---|---|---|

| 1 | 30% | -25% |

| 2 | 10% | -5% |

| 3 | 10% | 10% |

| 4 | -5% | 10% |

| 5 | -25% | 30% |

These scenarios utilize the same percentage growth in returns compared in reverse order. In measuring these scenarios without considering distributions or gains, they give the same yield after five years, $112,077 compounded annually, with the same compound annual growth rate, “CAGR “of 2.31%.

Now let us add contributions to the same scenarios. Common sense tells us contributions in any scenario would raise the CAGR. But you will see the order of market returns drastically changes the value and CAGR.

Under scenario A with a $10,000 contribution would result in an ending base value of $154,368 and a CAGR of 9.07%.

Under scenario B with a $10,000 contribution would result in an ending base value of $181,257 and a CAGR of 12.63%.

As you can see contributing $10k yearly in both instances triggers a much different outcome. Losses at the beginning of this 5-year market run results in an overall gain. A win for scenario A. The loser is losses sustained at the end of a market run, Scenario B.

However, with distributions rather than contributions the result ends in a reversed win/lose situation. Let us take a look at common distributions in the golden years of 10k annually:

Under scenario A with a $10,000 distribution would result in an ending vase value of $69,786 and a CAGR of -6.94%.

Under scenario B with a $10,000 distribution would result in an ending vase value of $57,196 and a CAGR of -10.6%.

The previous win before retirement becomes the loss during retirement. This outcome reflects the true application of “sequence of return and its’ risk”.

Sequence of returns is not emphasized enough in retirement planning. It is often dismissed by pointing to previous year gains or even the previous month gains for that matter. But a closer look at a simple 5-year market run shows how a retiree could be robbed of year of distributions.

It is important to note the difference between the CAGR and the sequence of return value. You cannot escape the sequence return value, but you can manipulate CAGR to avoid showing negative market runs by changing the time period. The CAGR considers averages over a time period. Whereas sequence of return is value received in a specific order. It is not affected by averages.

So why talk about a CAGR? It describes the overall grow or projected growth during a whole investment period. It is vital in comparing different investments over a period. But it is not revealing of the bottom-line value in any given day of a portfolio.

There are ways to minimize the risk with sequence of returns. The easiest is to avoid losses and take no withdrawals. This would avoid any negative compound interest during a declining market. Protecting against loss requires specific solution planning. most retirees are not fortunate enough to avoid yearly distributions. The key is to protect against a market downturn while still having an opportunity to gain in an upswing.

Even in situations where you cannot avoid a market downturn, you can minimize the impact. Planning for early down-market years by protecting income and limiting withdrawals is vital. Money intended and needed for a lifestyle should avoid risk. This strategy greatly improves your chances of not outliving your retirement savings. Easier said than done, however, many planning tools are designed to specifically address this pitfall. They protect against market declines and still allow opportunities for market gains.

The importance of protecting and balancing retirement benefits and investments has never been more important. You cannot afford piece planning. Planning is strategic and should be wholistic addressing the many pitfalls including the silent thief, “Sequence of Returns”.

Next, we will turn our attention to the pitfall of inflation.